Lots of issues that affect Americans' daily lives will likely come up at Monday night's first presidential debate.

Here's a cheat sheet of what to know about a host of issues of significance, from taxes and jobs to the military and immigration:

Taxes

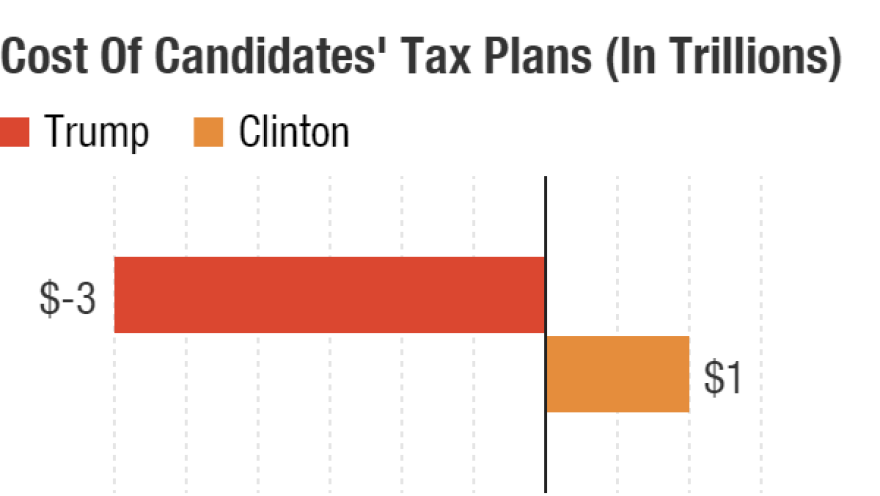

Donald Trumpwants to cut income tax rates while capping deductions for the wealthy. He would also reduce the business tax rate to 15 percent and eliminate the estate tax. The conservative Tax Foundation estimates that his plan would reduce federal revenue by $4.4 to 5.9 trillion over the next decade, which is a lot, but down from $10 trillion estimated from his original plan. Some of that could be offset by economic growth, but even using "dynamic scoring," the foundation says the plan cuts tax revenue by $2.6 to 3.9 trillion over 10 years. (The higher figure is if the 15 percent business tax rate is applied to "pass through" entities.)

The biggest beneficiaries of Trump's tax cuts are the wealthy. The top 1 percent of earners see their after-tax income rise by between 10.2 and 16 percent. Overall savings would be less than 1 percent.

Hillary Clintonwould raise taxes on the wealthy, especially those making more than $5 million per year (two out of every 10,000 people), limit the value of certain deductions and increase the estate tax and make more people pay it. Currently, only estates worth $5.5 million or more pay taxes on inheritance. Clinton would lower that threshold to $3.5 million per person and $7 million per couple.

On Thursday, Clinton proposed raising the estate tax from 40 to 45 percent. For estates worth $500 million for a single person and $1 billion for a couple, it would go up to 65 percent, the highest rate since the 1980s. Just 223 estates that were taxed in 2014 were worth $50 million or more. The rate is similar to the billionaire tax Clinton's Democratic primary rival Bernie Sanders proposed. Clinton's proposed tax increases could bring in up to $260 billion over 10 years. The Tax Policy Center estimates Clinton's tax plan overall would raise more than $1 trillion over a decade, with three-quarters of that coming from top 1 percent of income earners.

Jobs

Private-sector employers have added 15.1 million jobs since the trough of the recession in 2010. Unemployment, which peaked at 10 percent in October of 2009, has fallen to 4.9 percent. Unemployment among African Americans, which peaked at 16.8 percent in March of 2010, has also fallen to 8.1 percent, cut more than half yet still almost double the overall national figure. Unemployment among African American young people is not 58 percent, as Trump claims, but 26.1 percent.

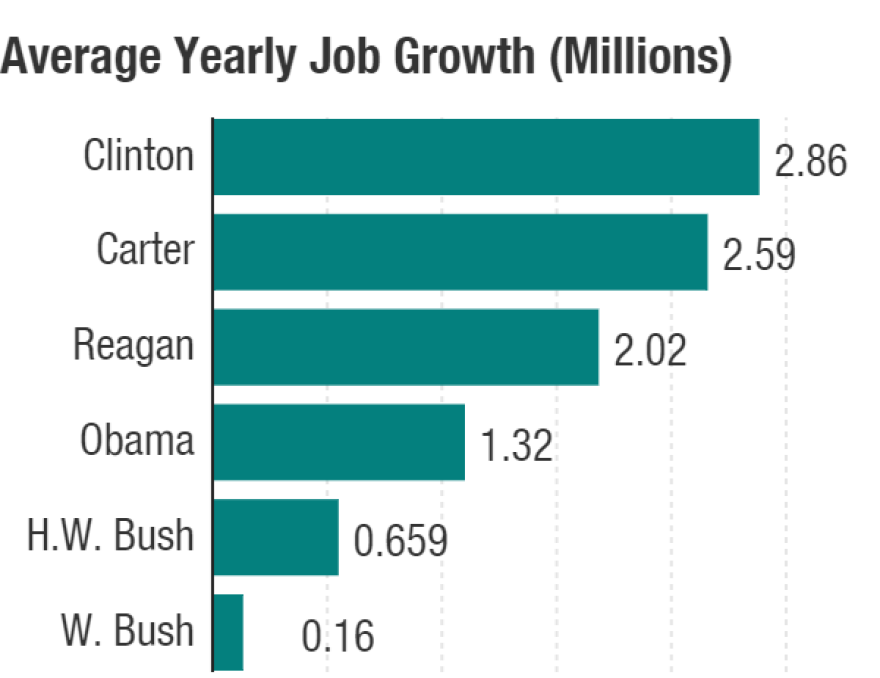

For a comparison of past presidents: The strongest average yearly jobs gains for each of the presidents over the last 40 years — Bill Clinton (2.9 million), followed by Carter (2.6 million), Reagan (2 million), Obama (1.3 million, as of January), H.W. Bush (659,250), and W. Bush (160,125).

Trump has made an anti-trade message the centerpiece of his jobs plan. Clinton came out against the Obama-proposed Asia trade deal. Clinton championed it as secretary of state, calling it the "gold standard," but she backed away during her primary against Bernie Sanders.

Trump has vowed to spend "at least double" Clinton's infrastructure plan, though he has not laid out specific details. That means Trump's infrastructure plan could cost north of half-a-trillion dollars. Clinton has proposed $275 billion in infrastructure spending over five years. Clinton is also proposing small-business tax cuts, investment in solar panels and scientific research.

In addition to infrastructure spending, Trump's plan centers on the growth-power of tax cuts; reducing regulations, especially ones aimed at the coal and natural gas industry and waterways, including "the smallest streams"; scrapping the Paris Climate Agreement; lobbying TransCanada to reapply for a permit for the Keystone Pipeline; expanding oil drilling; expanding childcare options (that would be difficult to pay for); cracking down on crime; and, of course, doing away with Obamacare.

Wages

Last week, we learned that median family income finally rose last year — by 5.2 percent, the first real increase since the Great Recession. Adjusting for inflation, the median is still slightly below the pre-recession peak of 2007, and below the all-time high which was reached in 1999. All races saw gains last year, with Hispanics seeing a 6.1 percent increase, whites 4.4 percent, and African Americans 4.1 percent.

Poverty

The poverty rate fell 1.2 percentage points, or 3.5 million people, to 13.5 percent in 2015. Still, 43.1 million Americans were living in poverty. In Obama's first year in office, the poverty rate was 14.3 percent. It peaked at 15.1 percent in 2010.

Some 45.7 million Americans were on food stamps (SNAP benefits) last year. In Obama's first year in office, there were 33.5 million. The number on food stamps peaked in 2013 at 47.6 million.

Trade

In 2015, the U.S. had a trade deficit with the rest of the world of $746 billion. In other words, the U.S. imports more than it is exporting. In the first seven months of 2016, the trade deficit was $424 billion.

Much of that deficit is with one country — China. In 2015, the U.S. had a trade deficit with China of $367 billion. In the first seven months of 2016, it was $191 billion.

So in both cases, the trade deficit is on pace to shrink, slightly this year.

Obamacare

The controversial health law, the signature legislative achievement of the Obama presidency, has pushed uninsured rate to an all-time low of just over 9 percent, while extending coverage to some 20 million people (including Medicaid expansion, exchanges, and young adults on family plans). The uninsured rate would be lower still had the 19 holdout states expanded Medicaid.

Competition on the exchanges, though, is shrinking. Fewer insurance companies are playing, and 19 percent of exchange enrollees will have just one company to choose from in 2017. (That's up from 2 percent in 2016.) Some 62 percent of enrollees will still have at least three choices. The problem tends to be worse in rural areas and in the South.

Premiums in the exchanges are on the rise. McKinsey Center looked at 18 states and found an average increase of 11 percent for the benchmark plan next year. Some of that increase will be absorbed by the federal government, as most exchange subscribers receive a subsidy. A study by the left-leaning Urban Institute found that even without the subsidy, exchange plans cost an average of 10 percent less than employer-provided coverage.

Military

Both Clinton and Trump want to lift the caps imposed on military spending by the Budget Control Act of 2011 (sometimes called the "sequester.") Clinton also wants to lift the corresponding caps on domestic spending, whereas Trump wants additional cuts in domestic spending to help offset the cost of his military buildup.

Trump wants to grow the active-duty Army from 475,000 to 540,000 soldiers, increase the number of Marine battalions from 24 to 36 (4,000 to 10,000 Marines), increase the number of Navy ships from 280 (planned) to 350 and add dozens of additional fighter aircraft. The New York Times estimates Trump's plan would costs $80 to $90 billion per year.

The Committee for a Responsible Federal Budget puts the pricetag of lifting the budget caps at $450 billion over the next decade (of which Trump's proposed offsets cover $300 billion at most.)

For context, per the Center for Strategic and Budgetary Assessments, the Obama fiscal year 2017 budget calls for $590 billion in Defense spending, including $58.8 billion for overseas contingency operations or war-fighting. Adjusting for inflation, the overall defense budget is down 25 percent from the peak in fiscal year 2010, at the height of the wars in Iraq and Afghanistan. It's still about 12 percent higher in real terms than the average during the Reagan administration. (Excluding overseas contingency operations, the base defense budget is down about 11 percent from 2010, and roughly equal to spending during the Reagan years.)

Defense spending amounts to about 3 percent of gross domestic product and 14.2 percent of total federal spending. (The Center for Strategic and Budgetary Assessments says defense as a percentage of GDP or federal spending is a poor yardstick for assessing defense needs, but a useful measure of affordability.)

Immigration

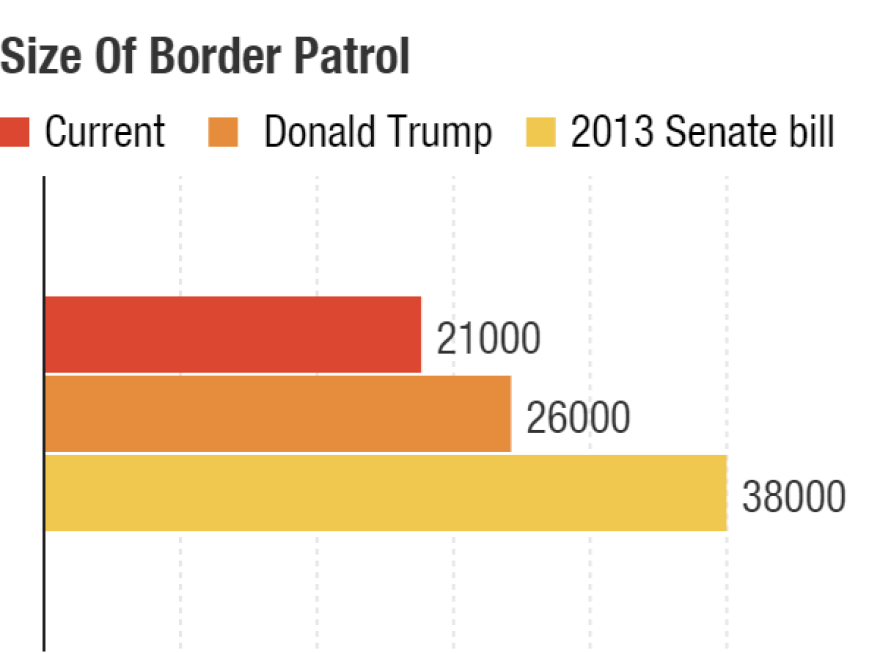

The Border Patrol has doubled in size since 9/11 to more than 21,000. Trump has proposed adding about 5,000 more. The bipartisan Senate bill in 2013 would have gone further, to 38,000.

Meanwhile, apprehensions at the Southwest border — a proxy for attempted crossings — have dropped by 79 percent from the peak in 2000. The Pew Research Center reports more Mexicans left the U.S. than entered between 2009 and 2014. For Central American immigrants, 122,000 families were apprehended in the first 11 months of the fiscal year, so on pace to match 2014 after a drop last year.

The number of immigrants in the U.S. illegally was about 11.1 million, as of 2014. That number has stabilized, per Pew, since the end of the Great Recession. The decline in immigrants coming from Mexico has been offset by growth of immigrants from Asia, Central America and sub-Saharan Africa.

Deportations increased during Obama's first four years in office, peaking in 2012 at nearly 410,000. Since then, deportations have been dropping, reaching a low of 235,000 last year. Since 2014, the administration has focused on deporting recent arrivals and criminals, with fewer deportations of long-time residents whose only crime was crossing the border. In all, about 2.8 million people have been deported under Obama.

Nearly one-in-five visitors who overstay their visas are from Canada, more than twice the number from Mexico.

Federal deficit

The budget deficit during Obama's first year in office was $1.4 trillion or 9.8 percent of GDP.

The deficit shrank in each subsequent year, bottoming out at $438 billion or 2.5 percent of GDP in 2015. (Thus Obama's line that he'd cut the deficit by three-fourths.)

It's rebounded this (fiscal) year to an estimated $616 billion or 3.3 percent of GDP, as a result of tax cuts and spending passed by Congress last year.

NPR's Domenico Montanaro contributed to this post.

Copyright 2021 NPR. To see more, visit https://www.npr.org. 9(MDEwMTk5OTQ0MDEzNDkxMDYyMDQ2MjdiMw004))